Margin of Safety

The Power of Paying Less: How Margin of Safety Boosts Returns

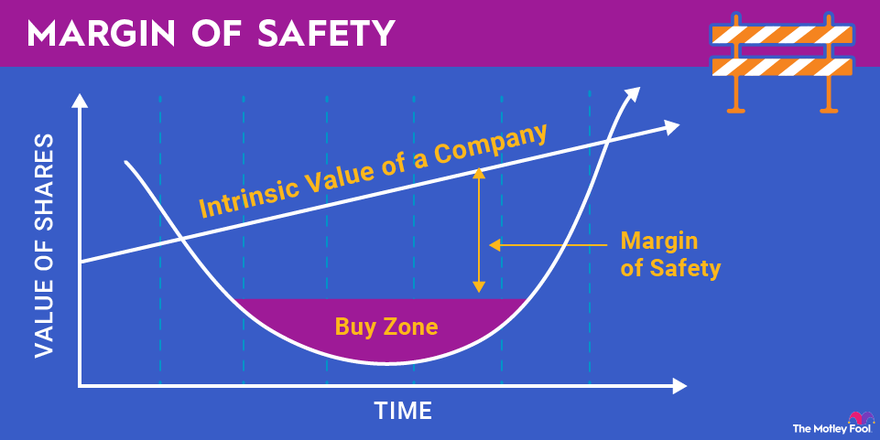

Imagine you're buying something valuable. You want to get it for a good price, right? That's the basic idea behind margin of safety in investing. It's the difference between what something is really worth (its intrinsic value) and what you pay for it. The goal is to pay less – ideally, a lot less – than its true value.

Why a Bigger Discount (Margin of Safety) is Better:

- Protection: A larger margin of safety protects you if things don't go as planned. If unexpected problems arise, you have more room before you start losing money.

- Exponentially Higher Returns: If things go well (or even just as expected), your profits are magnified when you buy at a bigger discount.

Example of Bigger Discount = Bigger Profit:

Let's say a stock is truly worth $100 (its intrinsic value).

- Scenario 1: Small DiscountYou buy it for $80 (a 20% discount).

- You sell it at its true value of $100.

- Your profit: $20, which is a 25% return on your $80 investment.

- Scenario 2: Big DiscountYou buy it for $50 (a 50% discount).

- You sell it at its true value of $100.

- Your profit: $50, which is a 100% return on your $50 investment!

See the difference? A bigger discount dramatically increases your profit percentage. This is why a larger margin of safety leads to exponentially higher returns.

Margin of Safety: Your Safety Net

Predicting the future is tough. Even smart investors can't always be right. A margin of safety acts like a safety net. It gives you room for error because:

- You don't need perfect predictions: You can be wrong about some things and still make money because you bought at a discount.

- It accounts for the unexpected: Bad things happen. A margin of safety helps cushion the blow.

The Right Price is Key

The bigger the discount, the bigger the margin of safety. But figuring out the right price to pay is tricky.

- Almost any investment can be good at the right price. Even a struggling company can be a good investment if you buy it cheap enough.

- Good companies can be bad investments if you overpay.

- Beware of temporary success: Don't assume a company will always do well just because it's had a few good years. Look for a lasting advantage and account for economic ups and downs.

- Growth stocks need extra caution: Be extra careful with companies expected to grow quickly. Make sure your expectations are realistic, and don't overpay.

Don't Put All Your Eggs in One Basket: Diversification

Even with a margin of safety, some investments won't work out. That's why diversification is important. It's like having a safety net for your entire portfolio.

- Spread your risk: Invest in different companies and industries.

- Wins will outweigh losses: If you buy a diversified group of undervalued assets, the gains from your successful investments should more than make up for any losses.

- Diversification and Margin of Safety are complementary.

In a Nutshell:

- Margin of safety is buying something for less than it's worth.

- A bigger margin of safety means lower risk and the potential for much higher returns.

- The right price is crucial.

- Diversification helps protect your overall portfolio.

By understanding and applying these principles, you can become a smarter and more successful investor.